The Ultimate Guide To Not For Profit Organisation

Wiki Article

The Best Strategy To Use For Non Profit

Table of ContentsSome Known Questions About Not For Profit.Non Profit Organizations List Things To Know Before You Get ThisExamine This Report about Npo RegistrationThe Best Strategy To Use For Irs Nonprofit SearchThe Greatest Guide To Non Profit Organization ExamplesLittle Known Facts About Not For Profit.

While it is secure to say that most philanthropic companies are ethical, organizations can absolutely struggle with several of the very same corruption that exists in the for-profit business globe - 501c3 nonprofit. The Blog post found that, between 2008 and also 2012, greater than 1,000 not-for-profit companies inspected a box on their IRS Type 990, the tax obligation return form for exempt companies, that they had actually experienced a "diversion" of assets, suggesting embezzlement or various other scams.4 million from acquisitions linked to a sham service started by a former assistant vice president at the company. One more instance is Georgetown College, who experienced a significant loss by an administrator that paid himself $390,000 in extra settlement from a secret checking account previously unidentified to the college. According to government auditors, these stories are all too common, and also act as cautionary stories for those that endeavor to produce as well as operate a charitable company.

When it comes to the HMOs, while their "promo of health for the benefit of the area" was considered a charitable function, the court determined they did not operate largely to profit the community by giving wellness services "plus" something extra to profit the area. Hence, the retraction of their excluded standing was supported.

7 Simple Techniques For Non Profit

Moreover, there was an "overriding government passion" in forbiding racial discrimination that surpassed the school's right to totally free workout of religion in this fashion. 501(c)( 5) Organizations are organized labor and farming as well as gardening organizations. Organized labor are organizations that form when workers associate to engage in cumulative bargaining with an employer regarding to earnings and also benefits.By contrast, 501(c)( 10) companies do not offer repayment of insurance policy advantages to its participants, therefore may set up with an insurer to provide optional insurance coverage without jeopardizing its tax-exempt status.Credit unions as well as other common financial organizations are categorized under 501(c)( 14) of the internal revenue service code, as well as, as part of the banking sector, are heavily managed.

Non Profit Organization Examples for Beginners

Getty Images/Halfpoint If you're taking into consideration starting a not-for-profit company, you'll wish to recognize the different kinds of nonprofit classifications. Each classification has their own demands and also compliances. Right here are the sorts of nonprofit classifications to aid you determine which is best for your company. What is a not-for-profit? A nonprofit is a company running to further a social cause or support a shared goal.Gives settlement or insurance coverage to their participants upon illness or other terrible life events. Membership should be within the very same office or union.

g., over the Net), also if the nonprofit does not straight solicit donations from that state. Additionally, the internal revenue service calls for disclosure of all states in which a nonprofit is signed up on Type 990 if the not-for-profit has earnings candid nonprofit of more than $25,000 annually. Penalties for failing to sign up can include being compelled to return contributions or encountering criminal charges.

How 501c3 Nonprofit can Save You Time, Stress, and Money.

com can help you in registering in those states in which you plan to get contributions. A not-for-profit company that obtains substantial sections of its income either from governmental resources or from direct payments from the basic public might certify as a publicly sustained company under section why not try these out 509(a) of the Internal Income Code.

Due to the complexity of the legislations and policies controling classification as a publicly supported company, incorporate. com recommends that any kind of not-for-profit thinking about this designation seek lawful and also tax advice to offer the needed guidance. Yes. Many people or groups create nonprofit companies in the state starting a nonprofit in which they will largely run.

A nonprofit company with service locations in numerous states might create in a single state, then register to do business in various other states. This means that not-for-profit corporations have to officially sign up, file annual records, as well as pay annual fees in every state in which they conduct business. State regulations require all nonprofit firms to maintain a signed up address with the Secretary of State in each state where they work.

The Irs Nonprofit Search Ideas

For instance, area 501(c)( 3) philanthropic companies may not interfere in political campaigns or carry out significant lobbying activities. Speak with an attorney for even more certain details concerning your organization. Some states only call for one director, yet most of states call for a minimum of 3 directors.

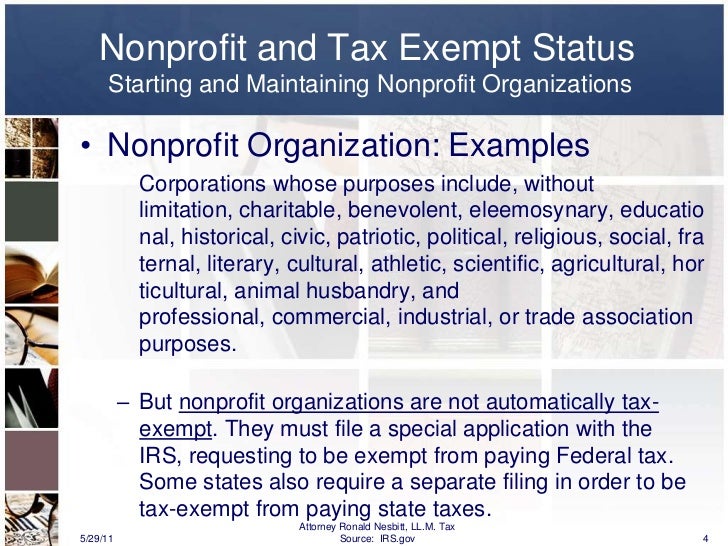

A company company that serves some public objective and therefore delights in unique therapy under the law. Not-for-profit firms, as opposed to their name, can earn a profit however can not be made primarily for profit-making. When it involves your business framework, have you thought of arranging your endeavor as a not-for-profit corporation? Unlike a for-profit service, a nonprofit might be qualified for sure advantages, such as sales, building as well as income tax exceptions at the state level (non profit).

The Of Npo Registration

With a nonprofit, any money that's left after the organization has actually paid its bills is placed back into the company. Some kinds of nonprofits can obtain contributions that are tax deductible to the individual that adds to the organization.Report this wiki page